* Cashback not applicable on cash advances, EMI, rent payment, wallet loads, jewelry, fuel, insurance services, education services, government services & Utility Spends that are not done on Airtel Thanks platform

#Valid on spends of ₹50,000 or more in previous 3 months

Exclusive Rewards

Activation/Welcome Benefit

Additional Benefit

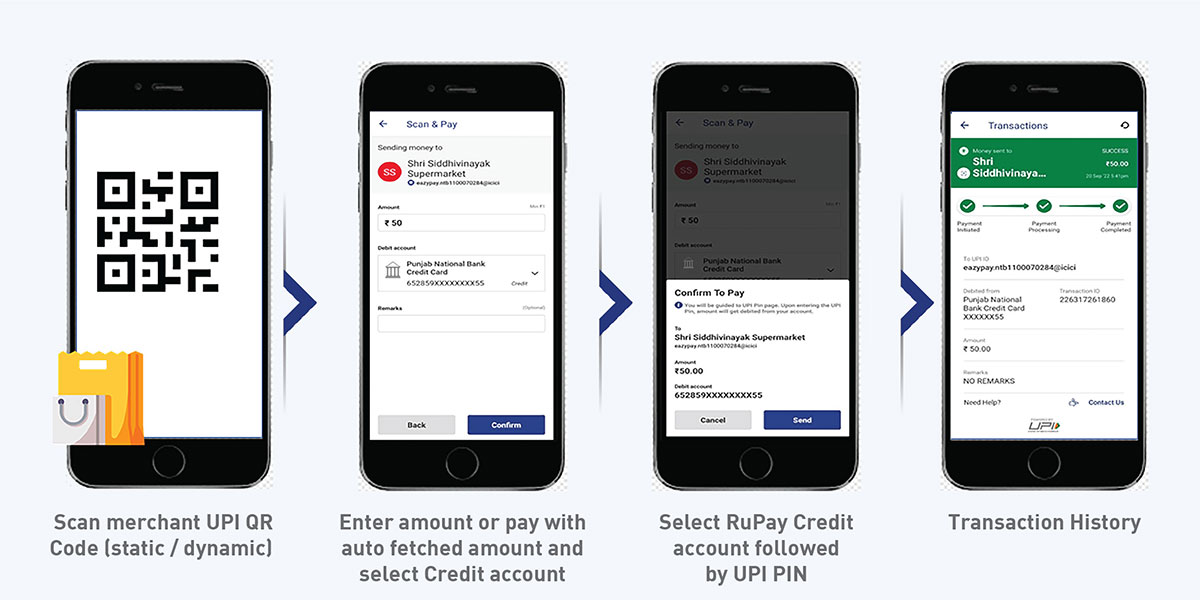

RuPay Credit Cards on UPI will provide a seamless, digitally enabled credit card lifecycle experience for the customers. Customers will benefit from the ease and the increased opportunity to use their credit cards. Merchants will benefit from the increase in consumption by being part of the credit ecosystem with acceptance of credit cards using asset lite QR codes.

RuPay Credit cards can now be linked to a UPI ID, thus directly enabling safe, and secure payment transactions.

Currently 23 banks are live to link RuPay Credit Card on UPI: Punjab National Bank, Union Bank of India, Indian Bank, HDFC Bank, Canara Bank, Axis Bank, Kotak Mahindra Bank, BOB Financial Services Ltd, Yes Bank, SBI Cards, ICICI Bank, AU SFB, IDFC Bank, IndusInd Bank, CSB, SBM Bank, Federal Bank, Saraswat Co-operative Bank Ltd, RBL, Utkarsh SFB, City Union Bank, ESAF Small Finance Bank, and IOB.

Currently the users can link their RuPay Credit Card on the mentioned UPI Apps: BHIM, PhonePe, GPay, PayZapp, GoKIWI, Slice, Paytm, MobiKwik, BHIM PNB, Canara Ai1, Groww, Cred, ICICIiMobile, Jupiter, Samsung Wallet, Navi, ShriramOne, FreeCharge, Amazon Pay, Fino Pay, Niyo Global, YesPay Next, Jio Finance, Union Bank of India (Vyom), Tata Neu, Flipkart, Bajaj Finance Ltd., PNB one, BoB World UPI, BHIM AU, Aditya Birla Capital Digital (ABCD), FamApp, IDFC First, POPClub, Freo, SalarySe, Supermoney, BharatPe, KreditPe, Airtel Thanks, OneCard, Genwise, INDMoney, Kotak811, Yono SBI, BHIM SBI, Curie money, Digibank (DBS India), Iris (YesBank), Money view, Okcredit, Rio money, Timepay, Twidpay, and Whatsapp.

Follow these simple steps to link your RuPay Credit Card with UPI.

You will have to setup UPI Pin to authenticate this transaction.

Please select the Credit Card from the linked credit card accounts, select set UPI Pin option from the dropdown. Enter last 6 digits of your RuPay Credit Card number, enter the expiry date, follow steps to complete the journey

Yes, you can change your UPI pin of your respective RuPay Credit Card account by selecting ‘Change UPI Pin’ from the drop-down menu. Follow the steps.

Select the credit card account for which UPI pin to be reset, select ‘Forgot UPI Pin’ from the dropdown menu. Follow the steps.

Open BHIM app on your mobile, click on ‘Scan’, QR scanner will open in BHIM app, scan the QR, enter the amount, select the masked credit card from the down menu, confirm the payment by entering UPI Pin. Payment confirmation will be displayed, once the payment is done.

Payment can be made for e-commerce merchant either through an Intent request or collect request from the merchant. Select BHIM as payment mode at merchant website /app, login into BHIM app, select the masked Credit Card from the drop-down menu, confirm the payment using UPI Pin. Payment confirmation will be displayed, once the payment is done, you will be routed back to the merchant page.

If you have changed your mobile number, kindly update the same at your Credit Card issuers end. Once updated, kindly re-register the credit card on BHIM app.

Select the Credit Card account for which you need to check the available and outstanding balance, click on ‘Check Balance’ from the drop-down menu and confirm using UPI pin, the available and outstanding balance will appear on the screen.

No, only payment to merchant (P2M) will be allowed from the linked Credit Card.

Currently, only RuPay Credit Card can be linked on UPI.

There is no restriction of linking RuPay Credit Card on UPI

There is no limit for the number of transactions carried out from linked Credit Card on UPI

Amount limit per card per day - UPI limit (1 lakh per day and 2 lakh for some special MCC codes), however it will be limited to the available credit limit on your card.

Customers will not be charged for linking or carrying out any transaction from the linked Credit Card on UPI.

Categories – P2P, P2PM, digital account opening, lending platform, cash withdrawal at merchant, cash withdrawal at ATM, ERUPI, IPO, Foreign Inward Remittances, Mutual Funds and any other categories as restricted by the issuing bank / RBI.

Yes, Credit Card bill payment can be done through the linked savings account from the BHIM App. For recurring bill payments, you can register for UPI AutoPay.

Yes, charge back or refund can be raised for the linked Credit Card through UPIHelp.

Credit Card cannot be made as a default option to receive funds

There has been a technical upgrade to provide a better experience. Request customers to set-up the UPI PIN again on the linked RuPay Credit Card account by selecting ‘Forgot UPI Pin’ from the drop-down menu. Follow the steps.

There has been a technical upgrade to provide a better experience. Request customers to remove the credit card from the BHIM app by selecting “Remove” from the drop-down menu and add the PNB RuPay Credit Card again. Follow the steps.

Yes, you can register your RuPay Credit card on the BHIM UPI app similar to the saving account linking process, and use the RuPay Credit card at any merchant. Please note, only Merchant payments are allowed from the RuPay Credit card linked to UPI apps.

To Enable the RuPay Credit card on UPI, the user needs to discover the Credit card issuer bank on the UPI apps under add Credit card option and link the card on the UPI apps. Post linking the user needs to set up UPI PIN for the linked Credit card using their Credit card details as guided in the UPI apps. After linking and PIN set, the user can use the RuPay Credit card for payment.

Amount limit per card per day - UPI limit (1 lakh per day and 2 lakhs for some special merchant category codes), however it will be limited to the available credit limit on your card.

You can perform a transaction using your UPI-linked RuPay Credit card at all UPI merchants.

Customers will not be charged for linking or carrying out any transaction from the linked Credit Card on UPI.

Yes, select Credit Card as an option in adding account tab. Select your issuing bank name from the drop-down. Basis the mobile number update with your issuing bank, masked Credit Cards will appear on the screen. Select the card which you want to link and confirm. Proceed to generate UPI PIN.

Yes, at the time of registration users need to select their credit card issuing bank name and follow the step to register in UPI apps.

Yes, customers can pay merchants using Credit cards registered on UPI.

No, Only Merchant payment is allowed from the Credit Card registered on UPI.

Payment can be made for online merchants either through an Intent request or a collect request from the merchant. Select UPI as payment mode at the merchant website /app, login into BHIM UPI app, select the masked Credit Card from the drop-down menu, and confirm the payment using UPI Pin. Payment confirmation will be displayed, and once the payment is done, you will be routed back to the merchant page.

Yes, register your RuPay Credit card on UPI apps and start using the Credit card for QR code payments.

Yes, register your RuPay Credit card on UPI apps and start using the Credit card for QR code payments.

Please download the UPI app (RuPay Credit card supported UPI apps) from Google Playstore/ App store. To complete the registration journey, select Credit Card as an option. Select your issuing bank name from the drop-down. Basis the mobile number update with your issuing bank, masked Credit Cards will appear on the screen. Select the card which you want to link and confirm. Proceed to generate UPI PIN.

Yes, customers can send money/ pay to merchants using Credit card registered on UPI.

Yes, please download UPI app (RuPay Credit card supported UPI apps) from Google Playstore/ App store. To complete the registration journey, select Credit Card as an option. Select your issuing bank name from the drop-down. Basis the mobile number update with your issuing bank, masked Credit Cards will appear on the screen. Select the card which you want to link and confirm. Proceed to generate UPI PIN.

Click on the Link RuPay Credit card on the Paytm UPI option on Paytm App. Select your issuing bank name from the drop-down. Basis the mobile number update with your issuing bank, masked Credit Cards will appear on the screen. Select the card which you want to link and confirm. Proceed to generate UPI PIN.

No, Only Merchant payment is allowed from the Credit Card registered on UPI.

Click on Add Credit Card option on Paytm App. Select your issuing bank name from the drop-down. Basis the mobile number update with your issuing bank, masked Credit Cards will appear on the screen. Select the card which you want to link and confirm. Proceed to generate UPI PIN.

Currently, on BHIM, Mobikwik, Paytm app, and Slice customer can link their RuPay Credit Card on UPI. Other apps are enhancing their tech platforms to enable the linking of credit card on UPI.

Currently, on BHIM, Mobikwik, Paytm app, and Slice customer can link their RuPay Credit Card on UPI. Other apps are enhancing their tech platforms to enable the linking of credit card on UPI.

Yes, customers can pay to merchants using Credit card registered on Paytm.

Click on the Link RuPay Credit card on Paytm UPI option on Paytm App. Select your issuing bank name from the drop-down. Basis the mobile number update with your issuing bank, masked Credit Cards will appear on the screen. Select the card which you want to link and confirm. Proceed to generate UPI PIN.

Currently, on BHIM, Mobikwik, Paytm app, and Slice customer can link their RuPay Credit Card on UPI. Other apps are enhancing their tech platforms to enable the linking of credit card on UPI.

Currently, on BHIM, Mobikwik, Paytm app, and Slice customer can link their RuPay Credit Card on UPI. Other apps are enhancing their tech platforms to enable the linking of credit card on UPI.

Currently, on BHIM, Mobikwik, Paytm app, and Slice customer can link their RuPay Credit Card on UPI. Other apps are enhancing their tech platforms to enable the linking of credit card on UPI.

Currently, on BHIM, Mobikwik, Paytm app, and Slice customer can link their RuPay Credit Card on UPI. Other apps are enhancing their tech platforms to enable the linking of credit card on UPI.

Yes, additionally apps such as BHIM, Mobikwik, and Slice also support linking of RuPay Credit Card.

https://www.npci.org.in/what-we-do/rupay/rupay-credit-card-on-upi